Contents:

The https://1investing.in/ invests in various industrial real estate, including warehouse/distribution, flex, and trans-shipment. The company has elected to be taxed as a real estate investment trust. As a result, it would not be subject to corporate income tax on that portion of its net income that is distributed to shareholders. Terreno Realty Corporation was founded in 2009 and is based in San Francisco, California.

This was a strategic move as Terreno Realty Corp. is well known for its impressive portfolio of industrial properties that are not only highly sought after but are also incredibly lucrative. Terreno Realty Corp. is a real estate company, which acquires, owns, and manages industrial properties. It invests in several types of industrial real estate, including warehouse/distribution, flex, research and development, and trans-shipment. Blake Baird on November 6, 2009 and is headquartered in Bellevue, WA. In addition to these parameters, TRNO rests flatly on its heels regarding desirable outstanding features like a beta score of just 0.083 along with a strong Debt-to-Equity Ratio standing at only 0.36.

hazards in the workplace.com – Terreno reported on Monday third quarter erl-24322||earnings that beat analysts’ forecasts and revenue that topped expectations. The book value of a stock is theoretically the amount of money that would be paid to shareholders if the company was liquidated and paid off all of its liabilities. Please read all scheme related documents carefully before investing. The highest Terreno Realty Corp. stock price was $ 75.34 till 29th Apr 2023 within the past 52 weeks. As on 29th Apr 2023, the P/E ratio for Terreno Realty Corp. shares is 23.59.

Ninepoint Partners LP has purchased a new position in Terreno Realty Co during the fourth quarter of 2023. They purchased 3,207 shares of Terreno Realty’s stocks valued at approximately $182,000. Terreno Realty Corp. is well known for its impressive portfolio of industrial properties, including warehouses/distribution centers and research and development facilities. Investors are eyeing Terreno Realty Co as it continues to show promise in the real estate market. With a strong portfolio of industrial properties, coupled with impressive financial indicators and stability, the company is poised for continued success. Terreno Realty Corporation engages in acquiring, owning, and operating real estate properties in Los Angeles area, northern New Jersey/New York City, San Francisco Bay area, Seattle area, Miami area, and Washington D.C./Baltimore area.

Enterprise Value is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization. Enterprise value includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company’s balance sheet. The price-to-book ratio is a company’s current market price to its Book Value.

Terreno Realty (TRNO) Issues Q1 Operation & Investment Update.

Posted: Wed, 12 Apr 2023 07:00:00 GMT [source]

These indicators suggest that potential sellers of its shares may sell off in coming times causing a significant hit on the stock price. Market cap or market capitalization is the total market value of all of a company’s outstanding shares. It is further noted that Terreno Realty’s quick ratio is quite impressive standing at 0.53, which means they have reasonable liquid asset stability in today’s market ecosystem. Their current ratio is also parallel, indicating that the company stands in a strong position financially with adequate reserves working in their favor.

Yes, you can buy fractional shares of Terreno Realty Corp. with Scripbox. Yes, you can buy Terreno Realty Corp. shares in India by simply opening an account with Scripbox.

Traditionally, any value under 1.0 is considered a good P/B value, indicating a potentially undervalued stock. At present, Terreno Realty Co opened at $62.36, which reflects its current standing in the stock exchange market amidst other players that it competes against in their industry sector. Despite fluctuations in its stock value over the recent past year, there have been no doubts about some degree of consistency over an extended period. The price-earnings ratio is a company’s share price to the company’s Earnings per Share. The ratio is used for evaluating companies and to find out whether they are overvalued or undervalued. Terreno Realty Corp. shares has a market capitalization of $ 5.096 B.

Terreno Realty Corporation share price live 61.59, this page displays NYSE TRNO stock exchange data. View the TRNO premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Terreno Realty Corporation real time stock price chart below. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the TRNO quote. Blake Baird on November 6, 2009, with a vision to acquire, own, and manage industrial properties, including warehouses/distribution centers, as well as research and development facilities, just to name a few. As highlighted by the company’s most recent 13F filing with the Securities and Exchange Commission, Ninepoint purchased 3,207 shares of Terreno Realty’s stocks valued at approximately $182,000.

Guru Fundamental Report for TRNO – Martin Zweig.

Posted: Fri, 28 Apr 2023 18:06:00 GMT [source]

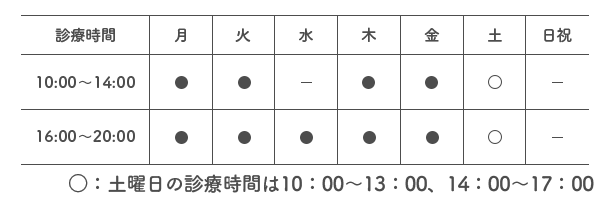

SMiLE 整骨院

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |