Casino free play is an alternat supercat casinoive to real money gambling. This lets you gamble on a variety of games without worrying about spending money. There are a few things you must be aware of. Here’s an overview of the pros and cons of this feature. First, keep in mind that free play is tax deductible. The second reason is that you’ll likely lose some money if you lose money. Finally, it’s not as much fun when you play for real money.

You can play for free at online casinos and play different games without having to deposit any money. You can play for as long as you want, try different games, and discover which ones you like best before you deposit any money. While it is a great advantage, it does lack the excitement and thrill of playing for real money. Always make sure to review the terms and conditions of any casino you are considering signing up at before you make a decision and start playing for real.

Most online casinos use software created by companies like CryptoLogic Inc., International Game Technology, Microgaming, Playtech, and Realtime Gaming. They can be classified into two types: download-only and web-based casinos. Some casinos offer both. Free play is a great opportunity to try the casino’s software and discover how it functions before placing an investment. Casinos online provide hundreds of games, and you’re sure to find something that you like.

Many people ask whether casino games that are free are tax-deductible. Free play is not considered to be income until you convert it into cash. Unlike free hotel rooms that aren’t considered gambling income until actually used, no free hotel rooms are. It is not clear whether free play is tax deductible until you actually utilize it. Here are some examples. It is not advisable to include cash received from a casino in your gambling income unless you are receiving cash from a casino. However, you should not include the cash you receive from free hotel rooms in your income tax return.

Free play in a casino is considered taxable when the casino earns some portion of the profits from their slot machines. Some casinos claim that free play amounts up to 15 to 25% of the revenues from slot machines. But this number is disputed since casinos do not always keep track of these amounts. Even though casino play for free is an essential part of their bottom line, casinos must pay tax on it when it boosts revenue and increases profits.

The term “comp” refers to items that are complimentary. These are items offered by gambling establishments to encourage customers to spend more and play more. These “comps” could be real money, or in the form of bonuses or free play. This is usually the best choice. But what happens if you can’t afford the items? Consider rethinking before playing for the comps. Here are lucky day some suggestions to maximize your chances of winning freebies.

Most casinos offer some kind of incentive for playing. New players earn the lowest comps. As you progress through the VIP levels, you will receive more comps. In some casinos online, you need to maintain your current level by earning points each month. For instance, if you play a certain amount of times each day, you may get an unrestricted meal or show ticket for playing at that casino for a certain number of days.

SMiLE 整骨院

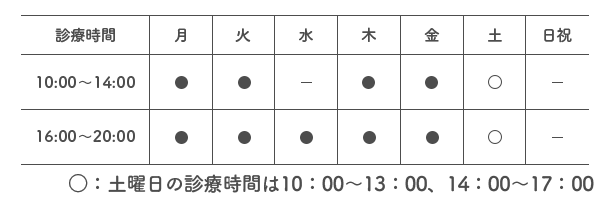

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |