Content

Intermingling expenses isn’t a fatal mistake but it causes problems for your business when it comes to claiming expenses and tracking the financial health of your business. For example, if a reasonable monthly payment for doing your books is $500, then cleaning up an entire year of neglect could be in the $5000 range. Low cost, hourly bookkeepers often do not have the technical expertise to handle more sophisticated issues like sales tax filings and certain audit procedures. We have some clients who pay a half percent of revenue, and some who pay more than 3% of revenue, but most fall in the 1-2% range.

The tax implications of this method also allow your firm to pay tax on income once it’s received and in the bank. Use software such as Clio Manage to help track your billable time, expenses and revenue. Additionally, keep your financial records in check by syncing to a system for accounting for law firms like QuickBooks Online. Effective accounting for law firms is critical to your firm’s success.

In addition to its real-time dashboard, which offers self-support features, clients can tap into inDinero’s support team via phone, email, or live chat. Lawyers usually begin their professional experience as employees of a law firm. At that stage of their career, they are learning – and have no option of incorporating. We proactive financial advice to help guide companies and keep them cash healthy, competitive, and fiscally sound. High-level reporting using firm specific data sets the stage for maximum return on your bottom line.

You can pay for additional tax services by adding BenchTax to your bookkeeping services. 1-800Accountant offers a nationwide team of Certified Public Accountants (CPAs), enrolled agents, tax professionals, and other experts lending their expertise to a full array of accounting services. Clients are matched with a local accountant or bookkeeper law firm bookkeeping who can provide state- and industry-specific guidance in managing their books. We are the most trusted choice in the area, offering comprehensive bookkeeping services specifically tailored for law firms. To effectively manage legal accounting for law firms, it’s wise to start with a foundation that works for all aspects of running your firm.

This will influence many other decisions, including the function of the services you provide, whether you want a physical or virtual location, your target demographic, and the location of your business. Quickly and easily capture time, create invoices and streamline accounts receivable. Monitor and manage Trust/IOLTA accounts and client trust liabilities to meet strict state bar regulations. The Federal Unemployment Tax Act (FUTA) tax provides payments of unemployment compensation to workers who have lost their jobs.

Embracing our specialized accounting legal bookkeeping solutions enables lawyers and law firms to leverage expert financial guidance without the burden of a full-time, in-house accountant. It’s a practical approach that ensures financial stability and empowers firms to focus on their core competencies. In many law firms, one employee handles all the bookkeeping and other back-office functions, leaving the company vulnerable during instances of illness, sick leave, or vacation. Keeping up with client billing and following up on unpaid invoices can be a considerable challenge while you’re juggling the workflow involved with multiple legal cases.

SMiLE 整骨院

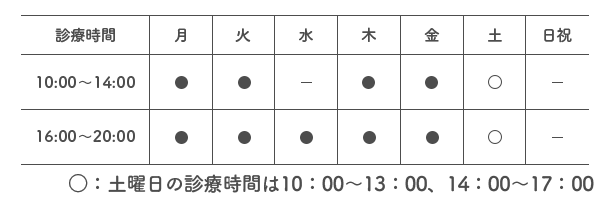

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |