Content

Real estate investment has certain distinct tax advantages over other investments; therefore, taking advantage of these tax benefits will help you maximize your investment return. As a taxpayer, you must report the rental income and can deduct several related expenses. Most people buy their own home first, and then when their equity grows, they take out another loan to buy investment properties.

This is because of the highly illiquid nature of real estate, which cannot be purchased and sold on a moment’s notice. As such, many people will opt to invest in real estate investment funds as a way to diversify and protect their holdings. Consider, for example, an instance in which the stock market plummets overnight. Real estate investment funds are generally structured to return profits to investors before any profit is earned by the fund’s sponsor.

Choosing the right fund can make the difference between a smart real estate investment and a less profitable one. During formation, the fund sponsor will establish the general parameters for investments. As noted above, some funds are structured to target investments in a specific product type, https://www.good-name.org/how-accounting-services-can-help-real-estate-companies-optimize-their-finances/ such as multifamily investments in core markets. Other funds may be more lenient with the product types and locations in which they invest. Sometimes, the fund will be created to have minimum threshold requirement. The formation phase helps to establish the fund’s “guardrails” and objectives.

Our ambition is to build the best global team – one that is representative and inclusive of the diverse talent, clients and communities we work with and serve – and to empower our team to do their best work. We support wellbeing and a balanced life, and offer a range of family-friendly, inclusive employment policies and employee forums. You can make a difference by working at BNY Mellon, where finance, technology and business intersect, to power the global financial industry. The information contained within this article is provided for informational purposes only and is current as of the date published. If the preferred return is noted to be paid first before any return of capital, excess payments cannot be considered “pre-paid” preferred payments. They are instead applied as return of capital at the point in time when the preferred hurdle is met.

Many traditional brokerages will not move funds from a traditional/Roth IRA or 401 to a non-traditional investment. Therefore, investors looking to pursue this strategy will need to direct the funds from their current brokerage account to an IRA custodian that allows for self-directed investment accounts. Managers responsible for real estate private equity funds need experts who truly understand their business.

A real estate fund is a type of mutual fund that invests in securities offered by public real estate companies, including REITs. 2. REITs pay out regular dividends, while real estate funds provide value through appreciation.

Fund accounting refers to the maintenance of the financial records of an investment fund. Accounting records must be kept for the investor activity, the portfolio activity, the income earned and the expenses incurred by the fund.

SMiLE 整骨院

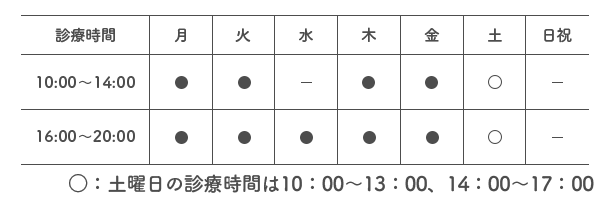

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |