Content

Lenders and investors want a clear idea of your business’ financial state before giving you money. They can’t do that without looking into things like revenue, cash flow, assets and liabilities, which they’ll search for on your balance sheet, income statement and statement of cash flows. Your team of small business experts imports bank statements and prepares financial statements every month. Your Bench bookkeeper works in-house, and they’re backed by our in-house research team to provide you with informed answers to complex questions.

However, accountants are brought in when the business needs more strategic advice, especially as it relates to taxes and corporate or financial planning. Learn more about the differences real estate bookkeeping between accounting and bookkeeping. Some businesses use employment agencies, talent marketplaces, or other platforms to hire, train, manage, and even pay employees and contractors.

The key is to get in a consistent habit so that you don’t forget.If you’re receiving multiple invoices a day, then posting daily is a good idea. You’ll need to record the money going out as well as the money coming in. Pay particular attention to your petty cash and remember to reconcile your accounts at least once a month. These tasks used to be managed using books and ledgers, hence the name “bookkeeping”.

All the accounting services reviewed here come with default settings that you may need to change. For example, do you plan to use specific features such as purchase orders and inventory tracking? You can usually turn tools on or off, which can help you either simplify the user interface or maximize the functions available to you.

They typically are performing basic bookkeeping duties and will need to be supervised and managed. One of the most common signs of an insolvent business is an inability to make payments on time. The business may struggle with a lack of funding, poor credit score, or difficulty fulfilling its working capital needs. When businesses use bank financing to fund their daily operations, they often struggle to pay back the high-interest debt.

SMiLE 整骨院

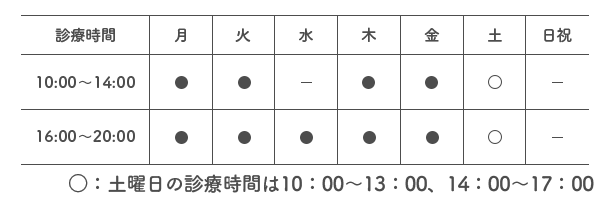

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |