In Kenya, fast lendings have become significantly preferred as a way for individuals to access funds in a rapid and practical manner. Whether you need money for emergency situations, service ventures, or individual expenditures, quick loans can of online personal loanfer you with the financial assistance you require. In this short article, we will discover the ins and outs of fast finances in Kenya, consisting of how they work, where to get them, and what to consider prior to using.

Quick fundings, additionally called fast car loans or immediate finances, are short-term financings that are generally processed and disbursed within a brief amount of time. These finances are made to provide customers with immediate access to funds when they are in immediate demand of financial help. Quick fundings in Kenya are offered from a range of financial institutions, consisting of banks, microfinance institutions, and online lending institutions.

Quick financings are usually unsecured, implying that borrowers do not need to supply collateral in order to get approved for the car loan. Rather, lending institutions evaluate borrowers based upon their creditworthiness and ability to pay back the funding. Consequently, quick finances often come with greater rate of interest contrasted to traditional car loans.

It is essential to note that quick financings are indicated to be made use of for temporary economic requirements and need to not be utilized as a long-lasting remedy to financial problems. Debtors should carefully consider their monetary scenario and ability to settle the funding before securing a fast lending.

There are numerous methods to gain access to quick lendings in Kenya, including conventional banks, microfinance organizations, and on-line financing systems. Each choice has its very own collection of needs, rate of interest, and repayment terms, so it is necessary to contrast your alternatives very carefully prior to choosing a loan provider.

Traditional financial institutions in Kenya provide personal lendings that can be processed swiftly, especially if you have a great credit history and a steady earnings. Microfinance institutions, on the other hand, cater to people that might not get fundings from typical financial institutions due to their credit report or absence of security.

Online lending systems have actually also ended up being popular in Kenya, supplying quick and practical accessibility to lendings without the need to instant small cash loans check out a physical branch. These systems make use of modern technology to examine customers’ creditworthiness and disburse funds within a short amount of time.

Prior to obtaining a quick funding in Kenya, there are numerous factors to think about to ensure that you are making the best decision for your economic scenario. Several of the key considerations consist of:

Quick financings in Kenya can be a practical and fast means to accessibility funds when you remain in immediate demand of economic help. However, it is very important to thoroughly consider your financial circumstance and the regards to the loan before using. By contrasting your options, comprehending the terms and conditions of the finance, and analyzing your ability to pay back the car loan, you can make an enlightened choice that is best for you.

SMiLE 整骨院

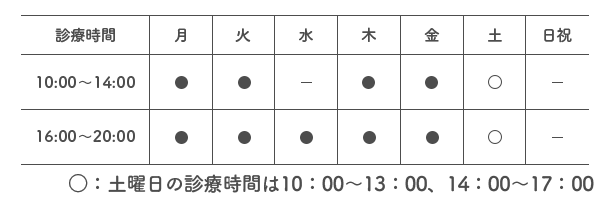

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |