Contents:

Whether you have a bullish or bearish view of an ETF price, you can speculate on either upwards or downward price movement. By purchasing an asset like an ETF on a regular basis, you can average out the price you pay over time as the price fluctuates. If you think an ETF price will rise, you can take a long position, whereas if you think the price will fall, you can take a short position. Avatrade offers you a wide selection of the Most Traded ETFs in the market.

Growth focused ETFs VOOG & SPYG hit 6-month trading highs.

Posted: Mon, 03 Apr 2023 07:00:00 GMT [source]

There can be differences during periods of heightened market volatility. Trading options on ETFs is an edge so few traders use because they simply don’t know how to look at the sectors and use them when creating their watchlists and making their trades. And with lower cost options, smaller accounts can take advantage of these market moves. ETFs tell us not only what’s happening at a specific, say granular level in stocks, but also what’s happening in a specific sector. Secondly, the SPDR S&P 500 ETF also needs to open in the upper part of the previous 5-day trading range. Simply mark on your chart the previous 5 trading days and the highest price of that trading range.

Index exchange traded funds allow investors to gain exposure to an entire stock market index, such as the S&P 500 , the Nasdaq 100 or the FTSE 100 . Index ETFs aim to track the performance of their benchmark index, either by holding the shares of the constituent stocks in the index or other investment products that follow its price movements. Equity exchange traded funds track indices covering groups of stocks, such as large companies, small businesses, dividend-paying stocks, and companies based in certain countries or specific sectors. For example, technology, consumer, banking and pharmaceutical ETFs allow investors to gain exposure to a variety of stocks in those sectors instead of buying an individual stock that may underperform. An exchange-traded fund is a type of pooled investment security that operates much like a mutual fund. Typically, ETFs will track a particular index, sector, commodity, or other assets, but unlike mutual funds, ETFs can be purchased or sold on a stock exchange the same way that a regular stock can.

To gain better returns, you should select an ETF with a lesser expense ratio than its peers. So, you have the chance to benefit if market perception favours the sector/market that the ETF follows. ETFs are also good tools for beginners to capitalize on seasonal trends. It refers to the fact that U.S. equities have historically underperformed over the six-month May-October period, compared with the November-April period. An investor may wish to take profits in this ETF and rotate into a more defensive sector such as consumer staplesvia The Consumer Staples Select Sector SPDR Fund . There are two major advantages of periodic investing for beginners.

6 Best AI ETFs to Buy for 2023 Investing U.S. News.

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

For example, an energy sector ETF will include companies operating in that sector. The idea behind industry ETFs is to gain exposure to the upside of that industry by tracking the performance of companies operating in that sector. An ETF can own hundreds or thousands of stocks across various industries, or it could be isolated to one particular industry or sector. Some funds focus on only U.S. offerings, while others have a global outlook. For example, banking-focused ETFs would contain stocks of various banks across the industry. ETFs can contain all types of investments, including stocks, commodities, or bonds; some offer U.S.-only holdings, while others are international.

Suppose you have inherited a sizeable portfolio of U.S. blue chips and are concerned about the risk of a large decline in U.S. equities. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Shares of Schwab are down nearly 23% in the past two trading days, making it the 12th-worst-performing financial stock in the S&P 1500. Investors are concerned the San Francisco-based financial giant too might be sitting on a pile of uninsured deposits from high-tech firms as in the case of the failed Silicon Valley Bank.

They can take anywhere from a few ukraine european union relationss to a few weeks to work out, unlike day trades, which are seldom left open overnight. Over time, this approach can pay off handsomely, as long as one sticks to the discipline. ETFs also exist for various asset classes, as leveraged investments that return some multiple of the underlying index, or inverse ETFs that increase in value when the index falls. “SCHW is a different story from SIVB in that SIVB had a concentrated segment of the deposit market, namely companies as their major deposit customers,” Kim said. “SCHW, on the other hand, is more main stream and across different customer segments. In addition, SCHW is insured by SIPC up to $500,000 per account, higher than $250,000 for FDIC and banks.” Miranda Marquit has been covering personal finance, investing and business topics for almost 15 years.

Ask price —This is the lowest price the seller is willing to accept for the ETF. Before you decide if an ETF is right for you, consider the pros and cons. Trade US Equities markets during local market hours or whenever it’s convenient for you.

An ETF provider takes into account the universe of assets, such as stocks, bonds, commodities, or currencies, and builds a basket of them, each with its own ticker. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. This professional-level platform lets you perform advanced charting, test out strategies with paperMoney® and find new ideas, all in one advanced trading platform. While purchasing an ETF may be more stable than putting all of your money into an individual stock, there is still potential for swings in the market.

However, there are some additional expenses to keep in mind when investing in an ETF. The potential combination of a recession and high interest rates could drive investors back to some of the most reliable companies on the market, and boost a few dividend ETFs. The S & P 500 Dividend Aristocrats Index includes the companies in the broader market index that have increased dividends for at least 25 consecutive years. The group added three new members earlier this year, including J.M. One fund that tracks the group directly is the ProShares S & P 500 Dividend Aristocrats ETF . The $11 billion fund has underperformed the broader market so far this year, with a total return of about 1%, but outperformed in 2022.

However, these are difficult methods, time-consuming and expensive ways to purchase gold. The tax on redemption of equity ETFs depends on the period of holding. If the holding period is more than a year, then there is long-term capital gain. For long-term capital gain of above Rs.1 lakh, the tax liability is 10% without indexation benefits.

As a journalist, he has extensively covered business and tech news in the U.S. and Asia. He has produced multimedia content that has garnered billions of views worldwide. Gordon Scott has been an active investor and technical analyst or 20+ years.

Supporting documentation for any claims, if applicable, will be furnished upon request. As you can see, the ETF market is very popular for both beginners and experienced traders alike. There is so much flexibility and many great options for you to make profitable investments that it is an appropriate place to trade.

Regulators get tough on crypto funds after FTX collapse.

Posted: Mon, 24 Apr 2023 04:06:18 GMT [source]

The second and most important step in https://1investing.in/ investing involves researching them. One thing to remember during the research process is that ETFs are unlike individual securities such as stocks or bonds. When the market declines, an inverse ETF increases by a proportionate amount. Investors should be aware that many inverse ETFs are exchange-traded notes and not true ETFs. An ETN is a bond but trades like a stock and is backed by an issuer such as a bank. Be sure to check with your broker to determine if an ETN is a good fit for your portfolio.

This provides some protection against capital erosion, which is an important consideration for beginners. The attributes of ETFs that make them suitable for swing trading are their diversification and tight bid/ask spreads. Arrange for a set amount of money to be moved from your checking account into your investment account on a regular basis. Then, you’ll provide instructions for the brokerage to buy as many shares as possible with the money in your account.

In some cases, you might have to provide a minimum deposit to open an account, though with ETFs, that minimum is generally only the cost of one share. If you’re just starting out, look for brokerages that offer affordable minimums or no minimum. Because you can’t just go to the store to purchase a basket of ETFs, the first thing you need to do is open a brokerage account. Before deciding where to open your account, though, it’s important to consider your goals. ETFs that let the investors trade volatility or get exposure to a specific investing strategy – such as currency carry or covered call writing, are examples of alternative investment ETFs.

ETFs are passive mutual funds that usually track benchmark indices like Nifty or Sensex. As an example, young investors might be 100% invested in equity ETFs when they are in their 20s because of their long investment time horizons and high-risk tolerance. ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. Keep in mind that bank accounts at Schwab are FDIC insured for up to $250,000. Also, securities and cash in brokerage accounts are insured by SIPC for up to $500,000 ($250,000 limit for cash). Looks like the financial stock market freakout is taking down more than just regional banks.

We love technical analysis because it has worked for us in our many years of trading, and for many other professional traders. Moving forward, we’re going to reveal what day trading rules you need to implement to successfully trade the SPY. These are reasons enough for us to pick SPY ETF as the right candidate for our day trading ETF strategy. If you’re not familiar with ETF trading and don’t have a complete understanding of how to trade ETFs, we hope this ETF step-by-step guide will provide some guidance. If you do so, you can certainly have a profitable experience trading ETFs. For those ETFs, which are less liquid, there could be a spread maybe 5% or even 10%, which is a massive price to pay.

An ETF is called an exchange-traded fund because it’s traded on an exchange just like stocks are. The price of an ETF’s shares will change throughout the trading day as the shares are bought and sold on the market. This is unlike mutual funds, which are not traded on an exchange, and which trade only once per day after the markets close.

It is similar to a mutual fund in the way that it is like a mini portfolio. Exchange-traded funds and mutual funds are quite popular among many investors. Both investment tools offer variety of options to the investors but are quite different from each other. From cost to management style, here is how ETFs are different from mutual funds. Many mutual funds, on the other hand, are actively managed, which means a fund manager is regularly picking investments and trying to outperform the market. More frequent buying and selling means more human management, and therefore higher fees.

Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. As ETFs are listed on stock exchanges, they can only be traded during the hours in which the market is open.

These index funds have been around for years, and they do exactly what you think they would do – offer ownership of stocks that make up an entire index, such as the S&P 500. When discussing the trading of ETFs and how to buy ETF shares, there are two types of trades you are going to be dealing with. If you are a retail investor and you will likely be making relatively small purchases, therefore, you will be trading ETFs in a similar fashion to normal stock trading. You will be able to see the bid/ ask prices through your given trading platform.

An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. A passive ETF is a method to invest in an entire index or sector with the benefits of low costs and transparency absent in active investing. An inflation trade is an investment scheme or trading method that seeks to profit from rising price levels influenced by inflation. If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. Note that your gains would also be capped if the market advances, since gains in your portfolio will be offset by losses in the short ETF position.

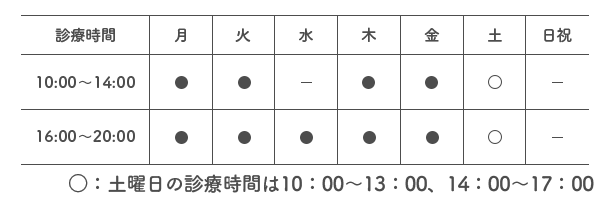

SMiLE 整骨院

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |