Content

Essentially, you can enter a virtual trading environment that allows you to open positions, track live data, and apply your strategies – without putting any real assets forward. It’s a risk-free way to practice your trading skills and gain more experience. Often, you’ll find demo crypto leverage trading for futures markets. So, it’s often recommended to get some spot trading experience first – learn to work with technical indicators, track market performance, and even compare different trading platforms. In many cases, you’ll be able to use demo trading to practice with leverage first. For starters, we’ll define what crypto trading with leverage is and how it relates to the concept of margin trading.

So, before you jump in, you might also familiarize yourself with our selection of the top five best trading strategies. He started trading forex five years ago, and not long after that, he picked up interest in the crypto and blockchain systems. He has been a writer since 2019, and his experience in the Fintech industry has inspired most of his articles.

Additionally, the exchange possesses best-in-class system architecture with advanced multilevel security and a network of global partners. All content on CaptainAltcoin is provided solely space for informational purposes. It is not an offer to buy or sell any security, product, service or investment. CaptainAltcoin.com does not offer any sort of financial or investment advice.

Of course, it sounds intriguing; however, it is a two-edged sword that not only benefits but also causes a nightmare for many beginner crypto traders when it is not properly managed. For this reason, you need to know what leverage is, how – it works, and how to manage your risk when using it. Let’s assume in this case that you want to open a $10,000 short position on Bitcoin with 10x leverage. You borrow Bitcoin from someone else and then sell it at the current market price.

Now, let’s find out what leverage is in crypto trading, how it works, and how it looks in an example. Delta Exchange has a daily trading volume of close to $500 million, which isn’t the highest but good enough. The exchange supports over 50 altcoins, and it offers an institutional-grade trading terminal. On top of that, you get 24/7 customer support and enterprise-grade security.

BitSeven is a crypto-leveraged trading platform that offers up to 100x leverage on trading Bitcoin. The leverage available on other altcoins is less than 100x but still quite high. Delta Exchange is a crypto derivatives exchange that supports futures and options trading with up to 100x leverage.

Spot trading is typically done using your own assets rather than borrowed funds. Traders that borrow to gain leverage may trade using the same markets as spot. However, trading with leverage in this way is less accessible than regular spot trading, since it’s more regulated and is seen as riskier.

One of the main advantages of using Kraken is its powerful trading platform. Besides, Kraken has a separate terminal for futures trading that encompasses more advanced trading features. On ByBit, you will be able to open positions with a margin and then use leverage to increase the capital.

Depending on the ratio of your assets vs. the borrowed funds, the trades have leverage. If the transaction succeeds, the leverage multiplies your earnings. If the price of the position drops, a margin call may be issued, and the trader may be forced to liquidate.

Overall, trading crypto with margin does offer day traders an excellent opportunity to increase profits. Other than the collateral, exchanges also require leverage traders to maintain sufficient margin for their trades. If the price of the asset that – you are leveraged trading goes in the opposite direction, your margin will start to drop. Leverage uses borrowed capital to trade cryptocurrencies, increasing your buying power and allowing you to trade with more capital than you might have.

Remember, each trade you open entails exposing a portion of your investment to risk in exchange for potential profits. Now, let’s see what happens when you create a short position with 2x leverage. Using $1,000 as collateral, a 2x leverage means you will have $2,000 in your account to short. If ETH depreciates by 30%, you can buy back (close the short position) and earn a profit of 60%. Always trade with caution and evaluate the risks before engaging in leverage trading. You should never trade funds you cannot afford to lose, especially when using leverage.

Before you decide on the amount of leverage you intend to use, you must first determine the percentage of your capital you intend to risk per trade. The common advice of many expert traders is not to risk more than 3-5% of trading capital per trade, no matter how promising it looks. This is because no trade has an assured outcome, and over-leveraging will put your wallet balance at high risk if the trade continuously goes against your prediction.

Felix has for many years been enthusiastic not only about the technological dimension of crypto currencies, but also about the socio-economic vision behind them. The reason is that companies engaged in this activity need specific licenses and permits to do business from each USA state, and they can cost an absolute fortune. For example, Kraken has costly licenses to conduct its trading products. In addition to them, there are requirements that Kraken must meet regarding fees, transactions, and more.

The amount of leverage a trader can take solely depends on a cryptocurrency exchange. Now that we’ve reached the end of our guide, let’s answer this question once and for all – what is leverage trading crypto like? Leverage is used to see by how much your trade will multiply if it succeeds or how much your losses may account for if the price drops. Although margin trading and leverage trading is similar and interconnected, they are not the same. Margin trading uses capital deposited in your account as collateral to borrow more funds from the crypto exchange for trading purposes.

It would be best to never trade with more than you can afford to lose and always take profits. Traders will open long positions if they believe the digital assets will increase in price; a short position is the opposite. So if the price goes down, you buy the same BTC at the lower price and return the lenders’ Bitcoin and keep the profits. For experienced traders that have a strict routine and strategies, it can be a very good addition to your wins where the added buying power will increase your profits.

These platforms offer Bitcoin and Ethereum investors the ability to unlock the value of their assets without having to sell. If you want to privatize your data and hide your IP address from hackers, using a virtual private network (VPN) is a superb choice. Using a VPN service helps obscure your online identity, allowing you to trade crypto online securely and anonymously. A VPN service makes your crypto trading more secure, free from hackers and other malicious software, even on public Wi-Fi networks. You can choose from several VPNs to keep your cryptocurrency secured.

Margin trading permits you to borrow money and trade more significant amounts than you would be able to if you only use your funds. On the contrary, margin trading also increases the risk of losing all of your money or being liquidated. What the broker earns is the trading fee which is also increased due to the increased position size, you can read more about fees and commissions further down on this page. Performing effectively with a leveraged trade enables you to diversify your investments in the cryptocurrency market across many exchanges. For novices, however, there are many factors in this industry to grasp what leverage trading involves to prevent significant market losses.

In other words, you borrow assets from a broker to use them to make trades. The act of using margin to trade is referred to as leveraging since it entails borrowing funds to maximize profits. Risk management strategies like stop-loss and take-profit orders help minimize losses in leverage trading. You can use stop-loss orders to automatically close your position at a specific price, which is useful when the market moves against you.

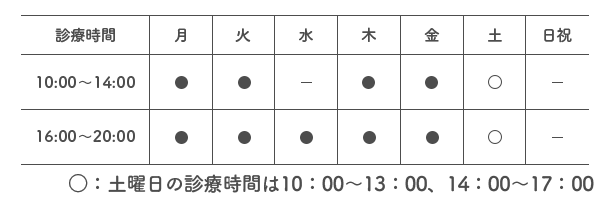

SMiLE 整骨院

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |