Content

If you’re monitoring these figures on a weekly basis, you can patch any cost leaks without incurring too many damages. Four-week periods, on the other hand, are always 28 days with four Fridays and four Saturdays. When you’re comparing accounting periods, you want to accurately compare revenue based how to do bookkeeping for a restaurant on times that should be equally as busy. To miskey numbers when you’re entering row upon row of data is also human. So is failing to recognize meal discounts or mis-logging sales as revenue. When you enter incorrect information into your books, you’re also skewing financial reports and KPIs.

When your employees pay for gas out of pocket as they drive on delivery or errand runs for your restaurant, they incur tax-deductible expenses. Restaurant accounting software mileage trackers automatically determine the distances your employees have driven and calculate your expenses accordingly. They then record these expenses in your accounting software to facilitate your tax reporting and filing. When you log into your restaurant accounting software, you should see a clear, well-organized dashboard with data visualizations and easily accessible accounting tools. Only consider platforms you can navigate intuitively, whether you’re seeking basic data or executing more complex tasks.

Of course, hiring professional bookkeepers also reduces the risk of error when it comes to your financial recordings. Diligent bookkeeping and expert accounting will lay the foundation for wise business decisions for your restaurant. Every restaurant has overhead, or fixed costs of running your business, such as rent, insurance, and equipment rental.

Long gone are the days when manually recording your financial data was feasible. Here’s why accounting software is highly advantageous — or outright necessary — for restaurants. You should be able to pay your vendors easily and on time from within your accounting software platform. These tools make it easy to pay your vendors and ensure timely payments that eliminate the potential for late fees. Spreadsheets are digital files employed for structuring data into rows and columns. Popular spreadsheet programs include Microsoft Excel and Google Sheets.

It is best to find a bookkeeper who understands the behind-the-scenes complexity of running a restaurant. Is your restaurant a single location or a small chain with multiple locations? Do you only serve food onsite and get paid at the POS or do you also send invoices to catering clients? These questions will determine which features you need in your accounting and invoicing software. Make sure that you review each plan offered by the provider and ensure that it contains the tools that you need for your restaurant’s individual needs. This establishes a connection between your business bank and credit card accounts, allowing for daily updates on transactions.

These tips are tailored to the restaurant industry, but there’s plenty more you need to understand about accounting processes. For a more general introduction to the basics of accounting, read our post on small business accounting tips. A few notable restaurant accounts payable services that are worth mentioning are XtraChef by Toast, MarginEdge, and PlateIQ. https://www.bookstime.com/articles/indirect-cost You would then have a payment approver approve any bills they want to be paid at anytime. This allows you to manage your accounts payable completely in the cloud and the ability to pay your bills from anywhere. To create a P&L for your restaurant, you subtract the total cost of goods sold from your Master Total for the week to calculate gross profit.

It’s an easy-to-use platform that allows you to track invoices, pay bills on time, set up payment reminders and export data into other programs. Plus, the very best POS systems are now integrated with Quickbooks, allowing you to easily track your financials. Key reports such as profit and loss statements, balance sheets, and cash flow statements offer valuable insights into your business’s financial performance. Analyzing these reports will help you make informed decisions and identify areas for improvement.

The accrual accounting method records income and expenses when you earn or bill them, even if you haven’t received or spent the money yet. Although It can be more complex to work on, the accrual method is the most widely used. The chart of accounts helps organize your financial transactions in categories that will give clear insight of your restaurant’s financial health. Food cost percentage shows how much of your overall sales are spent on ingredients and food supplies. Keeping tabs on your food costs will help you set menu prices and maximize profits. Food costs depend on the type of restaurant, but normally are around 28-35% or revenue.

This includes your rent or mortgage, equipment costs, insurances, permits, and other operational expenses. These fixed costs typically make up the minority of your restaurant expenses. The first-in, first-out (FIFO) method is widely considered the best way for restaurants to value inventory. Because restaurants often turn over perishable inventory quickly, it makes more sense to use a method that links inventory to its original cost. Accounting software for restaurant owners ranges from basic freeware to expensive custom solutions. The best choice depends on the size of your restaurant, as well as your financial needs and goals.

SMiLE 整骨院

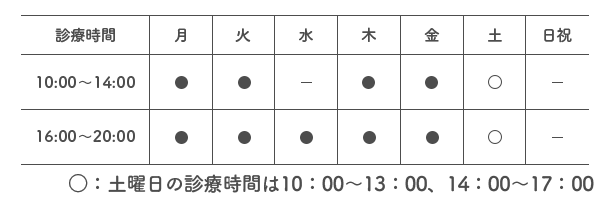

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |