In times of economic cris personal loans in nigeriais, unexpected costs can arise that leave us having a hard time to make ends fulfill. Whether it’s a clinical emergency situation, auto repair, or unexpected loss of earnings, these situations can leave us really feeling overwhelmed and unclear of where to turn for aid. This is where emergency financings can be a lifesaver.

Emergency financings are short-term loans made to supply financial aid in times of dilemma. These car loans are generally offered to individuals with a constant income and great credit history. They can be utilized to cover unforeseen expenditures such as clinical expenses, cars and truck fixings, or other emergencies that need immediate economic help.

Emergency situation finances are commonly unprotected, meaning they do not need security to secure the loan. This makes them a convenient choice for those who might not have assets to put up as safety.

These car loans are typically readily available from banks, cooperative credit union, and online loan providers. They can be acquired quickly, often within a couple of days, making them a fantastic option for those that require money quickly.

There are a number of sorts of emergency situation finances available to debtors, each with its very own terms and conditions. Some common kinds of emergency situation lendings consist of personal finances, payday advance, and title car loans.

Personal fundings are unsecured loans that can be utilized for a range of objectives, consisting of emergency situation expenses. These fundings generally have lower interest rates and longer settlement terms than various other sorts of emergency situation car loans.

Cash advance are short-term loans that are generally due on the borrower’s next payday. These loans are generally simple to get approved for but featured high rate of interest and fees.

Title lendings are protected lendings that call for the consumer to use their lorry as collateral. These car loans can be dangerous, as failure to settle the loan can result in the borrower losing their lorry.

When applying for an emergency loan, it is necessary to gather all required documentation and details in advance. This might consist of evidence of income, recognition, and bank statements.

It’s also vital to compare finance deals from various lending institutions to guarantee you’re getting the best terms and prices. On-line lenders typically supply quick authorization and financing, making them a convenient option for those in need of reserve.

When you have actually picked a lender, you can commonly obtain a lending online or face to face. The lending institution will assess your application and credit report to establish your qualification for the lending.

Emergency situation loans can offer much-needed financial alleviation in times of dilemma. They use fast access to funds and can assist customers cover unforeseen expenditures without considering high-interest credit cards or payday loans.

Emergency fundings can be a valuable resource for those dealing with unexpected costs or economic hardships. By comprehending the different sorts of emergency car loans readily available and exactly how to obtain them, debtors can make educated choices that will aid them browse difficult monetary situations with self-confidence.

Remain informed, remain ready, and bear in mind that help is constantly readily available when you require it most.

SMiLE 整骨院

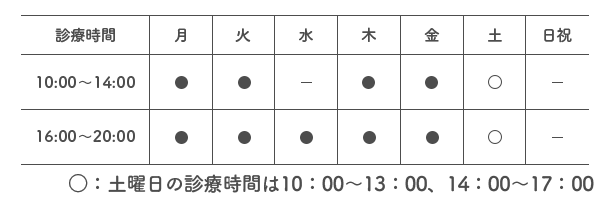

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |