Content

You can simplify the accounting procedures by getting in touch with experienced accountants for construction companies. Here at Appleby Mall, we’re always looking for new ways to support businesses in construction. There are relatively few accounting firms specialising in construction industry accountancy, but Appleby Mall is proud to be one of them. By making use of Xero software, we are able https://azbigmedia.com/real-estate/how-do-real-estate-accounting-services-improve-clients-finances/ to offer comprehensive construction bookkeeping services that keep up with your specific needs. Combining our experience with top of the line software allows us to craft specialised solutions for every client. On the one hand, overbilling ensures you receive payment before you start work, which can be a good thing, especially in the construction industry, which is notorious for late payments.

It can be hard to know where to start and how to ensure you’re covering all your bases. The key lies in understanding the foundations of construction accounting and implementing an accounting system that supports https://www.icsid.org/business/managing-cash-flow-in-construction-tips-from-accounting-professionals/ each. Select the CIS deduction rate for your subcontractors when entering their invoices into Clear Books. The CIS accounting software will automatically calculate how much CIS you should withhold.

This information can be tracked using a simple spreadsheet or online tool. Additionally, tax liability may change depending on the type of contract performed. For example, construction contracts that involve the completion of specific tasks or stages may have different tax implications than contracts where construction is ongoing throughout the project.

And so forsleek, stylish self-employed accounting software, Xero was our choice. Most construction invoices have payment terms of net 30 days, which means the invoice is due 30 days after the invoice date. Setting shorter payment terms can help with your cash flow or, at the very least, allow you to start chasing for the late invoice sooner. Small construction businesses and contractors face many challenges when trying to stay afloat amongst economic uncertainty, changing regulations and market sensitivity.

As well as taking care of your billing and invoices, they can also give you an overview of important reports like your profit and loss sheet and cash flow statements. Zoho Books’ mobile cloud accounting app lets you collaborate with your team, create quotes, track invoices, stay on top of your cash flow, and much more on the go. If you’re interested in building a perfect accounting system for construction company use, including residential construction real estate bookkeeping accounting, get in touch with the Appleby Mall team today. We can discuss your needs and help you to build a solution that works for your business. When you’re working in the world of construction, dealing with the financial aspects of your business is very rarely the first thing that you think about. However, keeping your company’s financial information and documentation in the best possible shape is at the heart of good business.

SMiLE 整骨院

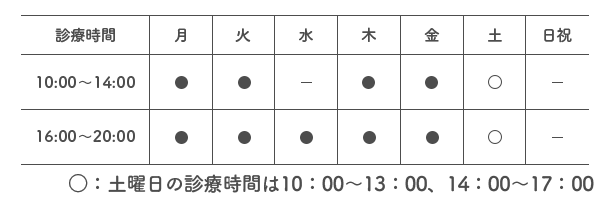

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |