What needs to be understood however is that a trader cannot simply look at the BBW value and determine if the Band is truly narrow or not. The significance of an instruments relative narrowness changes depending on the instrument or security in question. What is considered narrow for one security may not be for another. What is considered narrow for one security may even change within the scope of the same security depending on the timeframe.

A negative Pivot occurs when a severely oversold security strengthens and then fails. A pivot sell is marked by a red minus sign plotted above the day it occurs. Bollinger Bandwidth provides a relative measure of the width of Bollinger Bands®. Its most popular use is to identify “The Squeeze”, but is also useful in identifying trend changes. A higher plotted value indicates that the bands are further apart and a lower plotted value indicates that the bands are closer together. During periods of high share price volatility, the Bandwidth is wider, and vice versa.

The Bollinger Band Width is the difference between the upper and the lower Bollinger BandsOpens in a new window divided by the middle band. This technical indicator provides an easy way to visualize consolidation before price movements (low bandwidth values) or periods of higher volatility (high bandwidth values).

The indicator is typically used in trend-following and channel strategies. When volatility is high, bands are far apart, the bandwidth will also be wide apart. If you need to sort by a column that is not shown, use ‘Customize Grid Columns’ first to add the column. For example, you could add SMA Average Volume to the Grid and then reverse sort by that to show results in descending volume order. To adjust the settings of an existing Column just click on the Column to display the details popup.

The upper and lower bands are 2 standard deviations above and below the SMA (middle line). For such reasons, it is incorrect to assume that the long-term percentage of the data that will be observed in the future outside the Bollinger Bands range will always be constrained to a certain amount. Financial traders employ these charts as a methodical tool to inform trading decisions, control automated trading systems, or as a component of technical analysis.

For example, there are those who use Bollinger Bands in trend-following and those who use it to find reversals. This happens by looking at where the price is in relation to the Bollinger Bands indicator. Ideally, the Bollinger Bands indicator is usually narrow when there is no market volatility while its gap increases when market conditions change. Use caution and always consult your accountant, lawyer or professional advisor before acting on this or any information related to a lifestyle change or your business or finances. Equity line with BBW filter.In short, limiting trend-following entries based on market volatility levels produced good results in our test. As you see in the video, our coach compares the performance of this strategy, with and without BBW.

Spreads, Straddles, and other multiple-leg option orders placed online will incur $0.65 fees per contract on each leg. Orders placed by other means will have additional transaction costs. The bands incorporate standard deviation to chart a top and bottom line on either side of a stock’s moving average.

In this video, you’ll see BBW applied to a trend-following strategy, simply buying an asset when its price trend goes up and selling when its price trend goes down. The difference between the two bands can then be used as a filter for market entries; a narrowing of the width between the two bands is a condition for entry. Phases of flat calm, where volatility is very low, are usually believed to be followed by sudden movements that indicate a volatility explosion.

Saved lines will appear on all Charts for the symbol provided that the chart is shown with the same Period setting. After a short pause you will see a horizontal line with two small end boxes. And then move the ends in turn until the line is drawn correctly. Trend lines cannot be added when there are multiple Charts shown. To enable Trend lines ensure there is one Chart only on display.

The Squeeze can also be applied to weekly charts or longer timeframes. Volatility and BandWidth are typically higher on the weekly timeframe than a daily timeframe. This makes sense because larger price movements can be expected over longer timeframes.

The advance stalled in late September and BandWidth narrowed again in October. Notice how BandWidth declined below the lows set in August and then flattened out. The subsequent break below the lower Bollinger Band triggered a bearish signal in late October. Bollinger Band Width is a tool used in technical analysis that can help find “The Squeeze,” which, when acted on, can give decent buy and sell signals provided you time your entry and exit well. Even so, an analyst or trader who is well prepared can catch some good currency pair moves when a strong uptrend or downtrend comes after a squeeze. Various studies of the effectiveness of the Bollinger Band strategy have been performed with mixed results.

Most chart engines plot the indicator as an oscillator beneath the price chart. Bollinger Bands is a popular technical indicator that was developed by John Bollinger. It is a useful indicator that brings a new twist to the role of moving averages. In this article, we will look at what Bollinger Bandwidth is and how you can use it in day trading.

In the customization panel you can save chart versions and make copies. If you are viewing one of your existing Charts click ‘Apply Changes’ to save or ‘Copy’ to build an additional Chart based on the one currently on display. Most forex traders are trend traders and follow the trend using… Pivot points are an excellent leading indicator in technical analysis. This is a volume-weighted version of Gerald Appel’s MACD with 12 and 26 days used to calculate the indicator and 9 days for the signal line.

Therefore, in most cases, the Bollinger Bandwidth will not show you a signal of when to buy or sell an asset. Instead, it will guide you to be prepared of what will happen in the coming days. Another good example of this is Snap, which you can see in the chart below.

Positive PowerShift signals are marked by a rising wedge with a green core plotted beneath the day on which they occurred. W bottoms are technical analysis bottom formations that consist of a pair of lows separated by an intervening peak creating a W pattern. Our screening requires that the first low be outside of the lower band and the second low be inside the band.

The Bollinger Bandwidth indicator doesn’t help traders in any other way, so they have to use combine it with other methods to confirm entry and exit points. This may be determined by price action, the original Bollinger bollinger bands bandwidth Band, candlestick patterns, support and resistance, along with other concepts. A positive PowerShift signal occurs when a security has become severely oversold and strengthens enough to potentially break the decline.

Bollinger bands width percentile

It gives the probability of Bollinger Bands having a narrower upper band – lower band range than currently given. A Bollinger percentile of 93% (screenshot) means, that in only 7% of the last 1000 trading days Bollinger bands have been wider than they are today.

This scan reveals stocks whose Bollinger Bands just expanded rapidly after being contracted for 5 or more days. A channel (or band) is an area that surrounds a trend within which price movement does not indicate formation of a new trend. Periods of high volatility is followed by periods of low volatility. The page navigation links at the bottom of the Grid will vary depending on the sorted column. For example, you would see AAPL, etc if you sort by Symbol, APPLE INC, etc if you sort by Name, or 10,000,000 AAPL, etc if you sort by volume. These settings apply to all of your Charts across the site.

They can combine this insight with signals from other indicators, such as the accumulation/distribution indicator, to identify the direction of the impending breakout. If price is currently heading down and indicators are heading up, the sign is bullish. Bollinger %b is described by John Bollinger on his

website. It indicates the position of Closing Price relative to

Bollinger Bands® plotted at 2 standard deviations around a 20-Day

simple

moving average. Bollinger also describes a separate Band Width Indicator

that reflects the width of the Bollinger Bands.

Note how this strategy is used on a very diverse basket of futures spanning several different markets (energy, metals, equity indexes, and commodities) on data running from 2010 to 2020. Self-confessed Forex Geek spending my days researching and testing everything forex related. I have many years of experience in the forex industry having reviewed thousands of forex robots, https://trading-market.org/ brokers, strategies, courses and more. I share my knowledge with you for free to help you learn more about the crazy world of forex trading! We can transform Bollinger bands so that we measure their width, thus helping us understanding whether Bollinger bands-based strategies will work better or not. This article presents the details of the Bollinger bands width indicator.

With this information, you can then move ahead to open trades or anticipate moves. The second step is to subtract the value of the lower band from the upper band. This result will show you the absolute difference between the two. Now, to get the Bollinger Bandwidth, you then divide the middle band to normalize the value. We’d also like to point out that the Bollinger Band Width is particularly useful in the Bollinger Squeeze strategy. Whenever the Bollinger Band Width is at a significant minimum, a trader has a good opportunity to execute a Bollinger Squeeze trade.

How to Apply the Bollinger Bandwidth Strategy.

Posted: Thu, 19 Sep 2019 07:00:00 GMT [source]

If the BBTrend reads above zero, the signal is a bullish trend, and if the BBTrend reading is below zero, the signal is a bearish trend. The degree above or below zero determines the strength or momentum behind the trend. The BBTrend offers an alternative to the average directional index, or ADX, which gives similar readings. See Indicator Panel for directions

on how to set up an indicator — and

Edit Indicator Settings to change the settings. In the second scenario, the low bandwidth reading called the short-term top and subsequent price selloff.

A new decline starts with a Squeeze and subsequent break below the lower band. Bollinger BandWidth can be found in the indicator list on SharpCharts. The default parameters (20,2) are based on the default parameters for Bollinger Bands.

You can jump onboard the trend with a close stop below the most recent low. To profit on this setup, you can buy futures contracts or an ETF that mirrors the broad market. To determine your potential profit potential, review prior rallies to determine the mean. As you can see, the low points do not predict which way the market is going to break. You will need to use other analysis techniques to identify your edge.

In all the three instances price fell 5.6%, 3.6% and 7.6% from the short term market tops when the indicator dipped below 2%. In this article, I am going to cover some basic trading techniques you can use with the Bollinger Bandwidth indicator. Before we dive into the strategies, let’s first discuss the indicator. DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube. Like the Average True Range, the indicator tells you whether the market is volatile or not.

The authors did, however, find that a simple reversal of the strategy (“contrarian Bollinger Band”) produced positive returns in a variety of markets. Some traders buy when price touches the lower Bollinger Band and exit when price touches the moving average in the center of the bands. Technical analysis focuses on market action — specifically, volume and price. Technical analysis is only one approach to analyzing stocks.

BBW can be used to identify trading signals in some instances. To properly grasp the Bollinger Bandwidth indicator, we must first understand what Bollinger Bands are. The Bollinger Bands are a volatility indicator that plots three lines in relation to the price of a security. Usually, a 20-day simple moving average is used for the middle line.

This scan divides the difference between the upper band and the lower band by the closing price, which shows BandWidth as a percentage of price. In general, BandWidth is narrow when it is less than 4% of price.

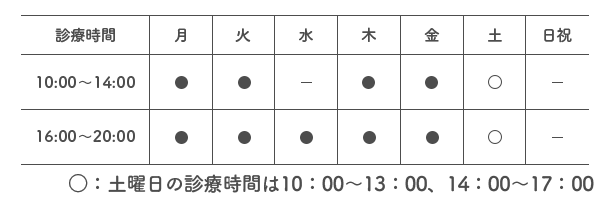

SMiLE 整骨院

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |