Content

Oscillators work well if you can identify divergence with the price movement on the chart. At the least, look for one other confirmation for range trading, rather than relying on the indicator. There are two fundamental elements to help you get started trading cryptocurrency. If you’re looking for a powerful mobile app, an unlimited demo account and the potential to diversify your portfolio massively, Plus500 is the place to be. Cryptomarket caps are small enough that they can be manipulated by a single big mover.

Crypto trading offers lucrative opportunities, but it also comes with its fair share of risks. Understanding these risks and implementing effective risk management strategies is crucial for success in the crypto market. But it takes a lot of dedication to reach a level of making consistent income.

Traders can practice spot trading on OKX by going to the “Demo trading” page. Once you have bought an asset, you need to sell it higher than you bought it to make a profit. Consider using the scalping trading strategy to monitor and identify a selling opportunity. – For instance, an AI-based crypto trading bot like Cryptohopper utilises machine learning algorithms to analyse vast amounts of data and generate trading signals. This allows users to take advantage of market opportunities with precision and efficiency.

With a primary focus on growth and profitability, HTX is providing users worldwide with professional services and a diverse product lineup, including PrimeVote, Flexi Max, Shark Fin, and more. HTX will also strategically partner with public chains like TRON, cross-chain protocols like the BitTorrent Chain, as well as stablecoin projects such as TrueUSD. HTX will continue to expand partnerships with different projects, public chains, stablecoins, and foster a multi-dimensional business ecosystem through collaborative efforts. You should put a stop loss whenever you open a position and move it up slowly (in case the price is moving in your favor) and bring it to a break-even point.

An experienced trader usually deals with the rise and falls of multiple coin assets at one time to maximize earnings, making this quite a hectic option. A trader planning to use scalping as a method of gleaning profits of the market also needs to have a defined exit strategy. This – is to avoid a large loss that could eat up small profits painstakingly earned so far. However, like scalping, day trading is a time-consuming and risky strategy more suitable for advanced traders. Swing trading might be the most convenient active trading strategy for beginners.

Because of their high volatility, cryptocurrencies are prone to attracting speculative attention and investors. For instance, intraday price changes can give traders excellent profit, but they also carry a higher risk like a sudden downward price trend leading to losses. Because an index fund replicates its underlying benchmark, it doesn’t require a large team of research experts to assist fund managers in selecting the best crypto assets. Additionally, when money is invested in a percentage similar to an index, the portfolio is diversified across multiple procedures. On the other hand, index funds are still riskier than government bonds or fiat/cash in that traders can lose money.

Cryptocurrency trading has gained significant popularity in recent years as it offers individuals the opportunity to speculate on the price movements of digital assets. Unlike traditional financial markets, cryptocurrencies operate in a decentralized manner, meaning they are not controlled by any central authority like banks or governments. This allows for greater accessibility and potential for profit arbitrage trading crypto bot in the crypto market. However, it is important to understand the basics before diving into this exciting world of digital currencies. Even the best crypto trading strategy means nothing if you don’t keep a close eye on the exchange rates. Be it between crypto-assets or between crypto and fiat assets, the exchange rate is a point that can be made profitable when utilized at accurate trade moments.

From there, you should take a look at the various cryptos and select an asset that matches your goals. Volatility is highest in altcoins with small market caps compared to the more popular and well-known cryptocurrencies like bitcoin or ether. Liquidity detection systems rely on recognizing the market engagements of other traders, frequently institutional investors.

Similarly, cryptocurrency gains are taxed at different rates – either as income or capital gains. In this section, we will discuss some of the most common crypto trading strategies. Although keep in mind that you can always create your personal strategy that works for you.

These strategies are just a starting point for beginners venturing into cryptocurrency trading. It’s important to remember that the crypto market is highly volatile, and there is no guaranteed approach for success. Developing a trading strategy that aligns with your risk tolerance and financial goals takes time and experience. While Bitcoin remains a popular choice for crypto trading, there are numerous other cryptocurrencies known as altcoins that offer unique features and potential investment opportunities. In the next section, we will explore some of these altcoins that traders frequently consider when entering the crypto market.

Currently, there are more than 20,000 cryptocurrencies listed on CoinMarketCap, a leading data aggregator for the cryptocurrency market. All in all, we recommend experimenting with the different indicators, learning more about them, and determining which one works well for you. When you decide on which strategies you will use, it is important to not get overly fixated on one strategy.

The indicator line oscillates between 0 and 100 and can be used to highlight when an asset is “overbought” or “oversold.” A channel between 30 and 70 is most commonly used to show this. When the indicator line breaks out of the channel above 70, the asset is considered “overbought” and the price will likely come back down. Conversely, when the asset breaks through the bottom of the channel below 30, the asset is considered “oversold,” which means the price will likely rise. Without using real money for trading, market participants can place simulated trades using Mock Trader. Participants in the market might use these trades to test a certain trading strategy or analysis. Cryptocurrency trading is the exchange of digital currency between traders.

EarlyBird helps parents, family, and friends collectively invest in a child’s financial future. So don’t bite your head off if you’re playing cautious and miss one, and don’t chase the gazelles that have already run off of the farm. Trading is more than anything an emotional journey — you must keep a clear head and stick to your chosen strategy through thick and thin. However, there are also some Telegram signal groups that provide free signals and training.

Crypto trading bots can streamline the process of looking at price movements, exchange fees, and opportunities to make short-term profits on trades. For decades, bot trading software has been a staple of brokerages trading on stock exchanges. Traders with an understanding of software programming and APIs should definitely consider using this to their advantage as a day trader. For prospective day traders, certain websites allow users to track and copy the most successful traders on the platform. Below are some of the most popular trading strategies in the crypto day trading game. Recently, the crypto markets have become an increasingly popular destination for day traders.

You buy a crypto asset, put it into storage, and let it sit in your wallet for a long period of time. The idea here is that your asset will increase in value over time without you having to take any action. As a result, the overall value of your investment portfolio will go up alongside those asset values. In practice, that means buying a crypto like Bitcoin through one exchange and then almost immediately reselling your new asset onto a different exchange for more money. You’re not going to make a huge profit doing this — but if you’re fast and know what you’re doing, it is possible to make a quick buck with this strategy. On the one hand, active trading strategies provide a level of excitement that many investors crave.

Scalpers may exit a trade seconds after entering, and many use automated bots to increase the frequency of their trading cycles. Ideally, scalpers want to exit a trade before any news item or short-term fluctuation has a chance to change the market’s sentiment on a coin. If you want to practice, some exchanges offer “dummy” accounts where you can trade fake cryptocurrency against real-world market data, so that you can learn the ropes with literally no risk. Telegram’s choice as the haven for crypto trading is primarily due to the density of the cryptocurrency trading community on the trading platform. It’s proven itself as the best medium for broadcasting messages to a large audience, especially due to the ever-changing nature of Cryptocurrency prices.

Check out this EarlyBird guide to find out about the best trading strategies. But you also need motivation, commitment, and a good understanding of the crypto market, trading, and strategies. You can choose established and large-cap coins like BTC and ETH or higher-risk medium or small-cap altcoins.

Emotional decision-making and impulsive trading can lead to poor outcomes. It’s crucial to approach crypto trading with a rational mindset and avoid chasing quick profits without proper analysis. Most cryptocurrency exchanges allow you to open an account and start trading with $200.

SMiLE 整骨院

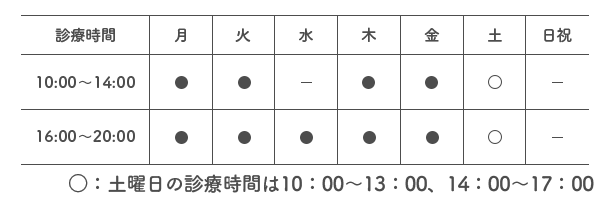

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |