If you’re planning to raise capital, we can handle your equity accounting, ensure financials are ready for audit, and achieve GAAP compliance. Many accountants offer bookkeeping as part of their accounting services or are willing to get you caught up before tax season. But the catch is that a CPA will generally charge more per hour than a bookkeeper would. They’ll typically charge their hourly rate, which is higher than a bookkeeper’s, because of the hard work in getting accredited.

It can provide investors (or those interested in investing) information about your company’s performance. It’s also a helpful way to analyze how your business has progressed over the years. They are usually much more well-informed than certified accountants as far as taxes go. EAs know all of the inner tax workings of whatever state you’re operating out of, as well as what the federal government is looking for. They can help by providing tax forms like 1099s to any independent contractors you hire. When you have up-to-date books thanks to your bookkeeper, filing your taxes will be a lot less stressful.

Merritt also offers catch-up services for those who are behind on their accounting, and they have a 100% money-back guarantee that ensures that you’ll love every feature, or you don’t have to pay. You don’t get a dedicated bookkeeper, but some companies don’t need that anyway. You’ll get access to a full team of bookkeepers with affordable plans that make running your business easier.

These accounting professionals also assist in auditing and cash flow management. Professional bookkeeping provides more in-depth financial reports than typical in-office bookkeeping. Because online bookkeeping uses virtual platforms, business owners can see their records anytime, including the cash flow and balance sheet. Comprised of over 3,400 professionals in the Philippines, the TOA Global team serves more than 1,000 accounting and bookkeeping firms worldwide.

I can concentrate on value add tasks like business reports and management summaries. We deliver a level of unwavering quality, consistency, and expertise in bookkeeping and tax return processing. Our firm’s prime concern is to maintain high standards for our clients in the US. Pilot is a bookkeeping platform that will change the way that your business thinks about keeping books. It was built entirely based on the services and needs of startups that are backed with venture capital. Every client is matched with their own bookkeeper, and they can integrate and get you set up easily.

Pilot is not a public accounting firm and does not provide services that would require a license to practice public accountancy. Most services will have an onboarding process you have to go through when you get started. This is also where you will connect your accounting software or get one set up if you don’t have one. BINERY works with a team of CPA-certified accountants and dedicated bookkeepers. We’ll manage your books all while solving any financial issues you may have.

We have been working with Mindspace for over a year now and will not be going back to doing the book-keeping ourselves in house. Our book keeping in Xero is now always up to date and accurate and I receive weekly summaries of any queries – a list which is getting shorter all the time. Our client, Daniel E. Greene, is a Los Angeles, California-based CPA firm, working with QX Accounting Services…

Bench is another accounting tech startup that offers outsourced bookkeeping and tax preparation services to businesses. Based in Canada, but only exclusively servicing small businesses and firms in the US. Here you are moving business processes and your in house accounting team to another country, typically one with a lower labor cost structure. What makes offshoring unique is that you essentially maintain full control over the financial data processing, which might be interesting if you’re providing client accounting services. When you offshore, you are hiring someone else in another country and they become your “employee”. For example, when you sign up with Bench, you’re paired with a team of professional bookkeepers who gather your data and turn it into tax-ready financial statements each month.

In addition, we reconcile bank accounts on an ongoing basis to ensure that the financial data we provide can be relied upon. Having an outsourced bookkeeping service provider is known to reduce many common errors made by business owners. Modern bookkeeping is often done through a cloud-based automated system that allows you and other experts to view your records at any time, so there are many eyes on your books.

It specializes in providing service to CPA firms and small, medium, and large businesses. Along with offering the typical outsourced bookkeeping services, AccountingDepartment.com provides outsourced controller services. InDinero offers tax, accountant, and financial services for businesses of all sizes.

Oftentimes, a bookkeeping service is essential for business growth and health. It leaves room for everyone in-office to be solely focused on their own tasks and can eliminate the cost of an in-house bookkeeping team. Paro’s platform connects firms to expert accountants based on their unique accounting needs.

All of their accountants and CPAs have bachelor’s or master’s degrees and receive regular training to expand their capabilities and offer quality service to their clients. However, while your outsourcing partner can prepare these statements to save you time and resources, you will likely review them for accuracy before passing them on to your clients. You accounts will be handled by experienced bookkeepers and reviewed by QuickBooks and Xero certified professionals. With BDO at your fingertips, you can access a full range of business services delivered by our relationship-driven advisers.

It’s a bit more expensive than some, but for those who use Xero, it’s the best choice. It’s also great for those who need pay-as-you-go solutions at a cheaper rate. For starters, choosing to outsource could save you as much as 83% when compared to hiring someone to do the work in-house. Want to kick off your small-business accounting with a solid accounting software service? Enter some basic information about your current accounting needs and we’ll send you up to five customized quotes. With Bench’s Catch Up Bookkeeping services, a Bench bookkeeper will work through past months of disorganized bookkeeping to bring your accounts up to date.

While a part-time or in-house bookkeeper may have a keen understanding of your type of business, you may face hurdles as your business expands. A part-time bookkeeper may not have the skill set to accurately set up the bookkeeping systems required to support a new area of business. You may then have to hire another bookkeeper who can cover the new aspects or find a different bookkeeper who can do both.

InDinero offers financial reporting, taxes, and a mobile app that makes it easy for everyone to communicate. It also has reasonable pricing for the features and makes it easy to scale a solution to suit your needs. Custom pricing is available for those who want accrual accounting and fractional List of Tangible and Intangible assets CFO services combined, while Essential plans start at just $300 per month. The Internet makes it easier than ever to take advantage of the solutions that are out there. If you’re not ready for an in-house bookkeeper or accounting team, outsourcing could be just what you need.

According to GrowthForce, outsourcing your bookkeeping will come with a price tag that spans anywhere from $500 to $2,500 per month. The main factors that will impact the cost are the number and complexity of services needed. That means cost will most likely scale with the size of business and financial accounts, so small businesses will pay less than enterprises for these services. While a certified public accountant (CPA) will provide insight and analysis of your financial data, bookkeepers will get into the nitty gritty of your day-to-day transactions. Bookkeepers are responsible for keeping record of all financial statements and transactions made by a business. They perform the preliminary functions needed in order for the accountant to do their job at the end of each period.

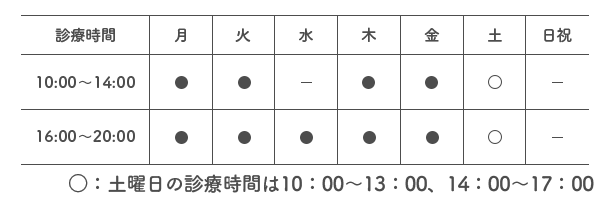

SMiLE 整骨院

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |