Factors contributing to the dollar’s uptick include more hawkish Fed talk, debt ceiling concerns, and satisfactory data. The 2-year yield has risen by 6.3 basis points to 4.067%, and the 10-year yield is up by 4.7 basis points to 3.554%. FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Gold price stays relatively stable on Wednesday but remains well below $2,000 following the sharp decline seen on Tuesday.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. The author has not received compensation for writing this article, other than from FXStreet. The big divergence with the MACD might also be a sign that we

could see a bigger pullback to the upside, but to confirm that, the price

should break above the trendline first. The US Dollar has been

strong recently due to better-than-expected data that might force the Fed to

hike again in June. So, paying attention to the economic data will be crucial

going forward. The Barchart Technical Opinion rating is a 88% Sell with a Weakening short term outlook on maintaining the current direction.

Data may be intentionally delayed pursuant to supplier requirements. Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers. West Texas Intermediate (WTI), futures on NYMEX, have defended their immediate support of $70.50 in the Asian session.

Thus, the value of the USDCHF pair is quoted as 1 US dollar per X Swiss Francs. Meaning, if the pair is trading at 0.95, it requires 0.95 Swiss Francs to buy one US dollar. If the USDCHF pair rises to 0.97, it means that the greenback has strengthened (the Swissie has weakened), and it now takes 0.97 Swiss Francs to buy one US dollar.

After multiple failed attempts to scale higher and set up an uptrend, BTC is back at the aforementioned barrier of $27,000. The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs. USDCHF Correlation

–

USDCHF real time currency correlation analysis.

Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. If price is near its low, traders may look to go long if they think the low will hold as a support level.

In so doing, it creates an appropriate environment for economic growth. USD/CHF represents how many Swiss francs are required to buy a U.S. dollar. Also known as trading the “Swissie,” this pair is sometimes seen as a safe haven due to Switzerland’s financial and political stability. Employment rates, GDP, and the disparity between interest rates set by the U.S.

If so, just spend 3 minutes of your time to sign up and start trading CFDs on USD/CHF with Capital.com. Try our award-winning trading platform or download our mobile app, which will become your smart CFD trading assistant. During that period, Switzerland had a large variety of different coins in circulation, including a high number of foreign currencies.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not invest money that you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. Will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Our currency rankings show that the most popular Swiss Franc exchange rate is the CHF to USD rate. Our currency rankings show that the most popular US Dollar exchange rate is the USD to USD rate. Use this to see how IG client accounts with positions on this market are trading other markets. Data is calculated to the nearest 1%, and updated automatically every 15 minutes. GDP data is regularly released which details the factors which can influence the CHF. Bitcoin price sits on a stable support level that has provided an opportunity for buyers to accumulate.

The USDCHF begins bullish correction – Analysis – 12-05-2023.

Posted: Fri, 12 May 2023 04:36:09 GMT [source]

USDCHF Historical Data

–

Historical USDCHF data selectable by date range and timeframe. There are various socio, political and economic factors that cause the rise and fall of the US dollar price. Discover factors impacting the dollar price in an ever-changing global economy. The percentage of IG client accounts with positions in this market that are currently long or short.

In this technical article we’re going to take a quick look at the Elliott Wave charts of EURNZD published in members area of the website. Weakness in the Chinese yuan was supportive for the dollar after weaker-than-expected Chinese economic news knocked the yuan down to a 2-month low Tuesday against the dollar. Essential reading for all beginning traders – a detailed explanation of trading terminology and concepts. The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in.

If you think the US dollar will appreciate then take a long position by buying the CFDs. If you think the US dollar will lose value against the Swiss franc then you would take a short position by selling CFDs. Global risk sentiment for the next few days will be driven by the US debt ceiling theater. While the looming uncertainty makes the markets hard to navigate in the short run, there is a good chance that the drama comes to an end within the next few days. In our latest Elliott wave live session, we covered plenty of markets and analysis, including a discussion of currency correlations and recent market movements. Tuesday’s U.S. economic news was mostly better than expected and bullish for the dollar.

This widget shows the latest week’s Commitment of Traders open interest. The COT data, as reported by the US Commodity Futures Trading Commission https://business-oppurtunities.com/using-a-free-email-address-for-advertising/ (CFTC), is from Tuesday, and is released Friday by the CFTC. Reporting firms send Tuesday open interest data on Wednesday morning.

The content on this website is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. As with all currencies, economic and political events and occasional crises can play a part in affecting the fluctuations in the exchange rate.

You can either hold a long position (speculating that the price will go up) or a short position (speculating that the price will fall). This is considered a short-term investment or trade as CFDs tend to be used within a limited timeframe. A pip is merely the smallest increment of trade in the foreign exchange market. It stands for ‘percentage in point.’ GBP/JPY is quoted to two decimal points, so a pip is just the lowest amount that can possibly be added to (or subtracted from) this figure. For instance, to trade the USD/CHF currency pair using CFDs, you speculate on the direction of the underlying asset.

News and data about the US economy and politics are constantly available and should be followed to keep up to date with factors which can influence the markets. Role of CHF Despite its relatively small economy, Switzerland has very strict banking policies in place which can influence the movement of the price of the franc. This is partly due to the widespread perception of the country’s political neutrality, and for it being a leading force for financial privacy and security.

The US dollar needs no introduction and is paired to all the main currencies. It dates back to 1792 when the United States Congress created the US dollar as the country’s currency. It serves as legal tender in a number countries and is it still regarded as the world’s unofficial reserve currency. However, traders should note that navigating such volatile swings can be challenging, requiring a mix of luck and willingness to adapt when predictions miss the mark. Given the market’s uncertainty, it might be wise to remain flexible or even consider sitting out until clearer direction or fundamental clarity emerges.

Apr retail sales ex-autos rose +0.4% m/m, right on expectations. Also, Apr manufacturing production rose +1.0% m/m, stronger than expectations of +0.1% m/m. In addition, the May NAHB housing market index unexpectedly rose +5 to a 10-month high of 50, stronger than expectations of no change at 45. The Swiss National Bank conducts the country’s monetary policy as an independent central bank. It is obliged by the Constitution and by statute to act in accordance with the interests of the country as a whole. Its primary goal is to ensure price stability, while taking due account of economic developments.

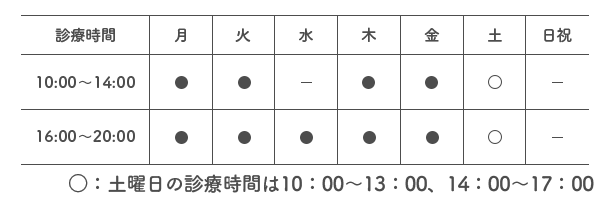

SMiLE 整骨院

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |