Content

In other words, each transaction results in one account being debited while another account is credited. The total of all debits always equals the total of all credits for any given transaction. The accountant makes the debits on the left side of the ledger and the credits on the right side. These credits and debits result in either decreases or increases in accounts depending on what types of accounts the transaction impacts.

If there is a prior agreement with the account provider for an overdraft facility, and the amount overdrawn is within this authorised overdraft, then interest is normally charged at the agreed rate. If the balance exceeds the agreed facility then fees may be charged and a higher interest rate might apply. Telephone banking provides access to banking transactions over the telephone.

Some type of substantial measurability needs to exist in order to consider it a transaction. The $10,000 is your owner’s equity and is the first transaction in your books. You decide to open up a small business selling a wide variety of handmade items. After you save up the money, you deposit the cash into a new business bank account. They don’t involve any sales but rather other processes within the organization. This may include computing the salary of the employees and estimating the depreciation value of a certain asset.

With the use of accounting software, an enormous quantity of transactions can be recorded into many detailed accounts. The term financial transaction is viewed as a business dealing, which involves the exchange of goods or services for value between two or more parties, firms or account. Any event which has some https://www.bookstime.com/accountants monetary impact on the financial statement of the business is called as a transaction. It may result in lt in the movement of value from one person to another. When a transaction is labelled as a cash transaction, it signifies that the payment was made or received in cash at the time of the transaction.

For example, if Mary buys a new shirt from a store and pays at the checkout, Mary and the store have engaged in a cash transaction. Even if the payment is made with a debit or credit card, this transaction is still recognized as a cash transaction since the payment is made at the time the transaction occurs. Examples of transactions include the payment of salaries to workers, the purchase of merchandise from a supplier on credit, or the purchase of machinery for cash. Cost of goods sold is an expense account and sales is a revenue account.

Every event shall measure in terms of money so that the monetary impact can be calculated easily. This is the method of recording manually or entering into the modules of accounting software to provide impactful data to the company. Analysis- The accounting transaction is entered through a journal entry in the books of account every month when the checking account is balanced. As the money is removed from the checking account, cash is being credited and the balance is decreased by $20. The expense account is known as Bank service charges receives the debit. Debiting the bank fees means increasing its balance by such amount.

If your company needs help with analyzing business transactions, consider reaching out to a business lawyer or licensed CPA. Company ABC has also recently sold $10,000 worth of clothing to customers. This entry for this transaction would be the reverse of the previous one. transaction analysis The cash account would be debited $10,000 and the inventory account would be credited $10,000. This is because cash is being received and inventory is being sold. Businesses that use cash-basis accounting must record income or expenses when the payment is received or made.

Maintaining accurate records of transactions is especially helpful in deterring and detecting fraudulent activities such as embezzlement and money laundering. Each transaction is recorded in the accounting system by a general journal entry. Signing of business contracts, on the other hand, don’t change the accounting equation, so they are not usually recorded as a transaction. To record receipt of the loan, debit the cash account by the amount of the loan.

Examples of ACH transactions include direct deposits for things like your salary or tax refund, and bill payments that are made online or through your bank. A business may purchase $500 of office supplies in May, for example, and pay for them in June. The business recognizes the purchase when it pays the bill in June.

SMiLE 整骨院

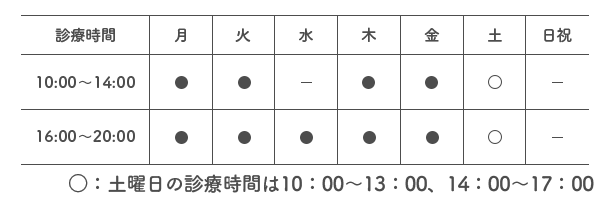

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |