Content

Sage 300cloud Streamline accounting, inventory, operations and distribution. Sage 100 Contractor Accounting, project management, estimating, and service management. Sage Intacct Advanced financial management platform for professionals with a growing business. For the above example, you assume that you sold the cheaper dice first.

The clearing house standard: Aspirational model for accounting ….

Posted: Thu, 01 Dec 2022 08:00:00 GMT [source]

If you want accountants to have access to your dashboard, reports, invoices and expenses, you can assign them permission, as well as grant other users access to different features. If you have employees, you can give them access to their projects and track their time and additional expenses. FreshBooks has over 100 partners, so you can add plenty of features and connect with other business programs.

Additionally, the platform provides mobile apps to keep you connected with customers, and your accounting records always within easy reach. There are three double-digit figure subscription plans starting with the Lite package at $15/month. QuickBooks is an easy-to-use accounting software for organizing receipts and other important records. You can use it to track your income and expenses, evaluate all kinds of maintenance and inventory costs, and record sales your business makes over a period.

Think of retained earnings as your store’s savings account. Keep detailed records of what goes into savings, what comes out and any interest earned in a retained earnings account. To steer clear of accounting blunders, inaccurate tax filings, and overspending, open a separate bank account for business. Manually recording transactions by hand is the most time-consuming option for recording transactions. However, it is the cheapest solution for small business owners.

It’s important to note that the cost of accounting software can vary greatly, so it’s important to compare different systems and plans to find the best fit for your business. You can choose a basic system and add à la carte options such as project management or CRM, or you can choose an all-in-one system that includes everything you need. Its invoices plan is free, and its accounting plan is $20 per month. For advanced accounting, go with its kashoo plan for $30 per month. Kashoo offers a free 14-day trial with any of its paid plans. For VIP Service, it’s an additional $50 per year and comes with one-to-one training, a dedicated support team and early access to new features.

One of the most important—and often most difficult—rules to follow when running a small business is keeping your business and personal expenses separate. You can find free templates online, but as your business gets more profitable—or more complicated—you’ll need to consider working with a professional to manage these documents. Your profit and loss statement is a summary of your revenue minus expenses for a period of time, usually a quarter of the year at a time. It shows your profits or losses at a glance for that chunk of time. RamseyTrusted tax pros are an extension of your business.What is an expense?

Most small business accounting services also offer the option to import existing lists in formats such as CSV and XLS. Keeping a tight grip on finances is critical for the success of small businesses and freelancers. We’ve tested the best small business accounting tools to help keep your company in the black. This software has a clean interface and also fully integrates with a third-party payroll service.

You should set up your books as soon as possible after starting your business. The longer you wait to get started, the harder it will be. If you keep track of your financials on anything else, you will eventually have to transfer your data over to the software anyway before an accountant will look at it. Business owners typically put off setting up the books until tax season, which leaves them with a large amount of work and very little time to do it. From payroll taxes to managing invoices, efficient bookkeeping smooths out the process of all your business’s financial tasks and keeps you from wasting time tracking down every dollar. At least once a week, record all financial transactions, including incoming invoices, bill payments, sales, and purchases.

Our retail accounting software helps you seamlessly stay on top of it all, from inventory to expenses and more. Accounting software can improve productivity by automating time-consuming tasks, such as invoicing https://www.scoopbyte.com/the-role-of-real-estate-bookkeeping-services-in-customers-finances/ and tracking payments. This frees up your time so you can focus on running your business. Plus, software can help keep your books in compliance, which can save you time and money in the long run.

Find out what business structure is best for your small business and what the tax implications are for that setup. A sale is a transaction you receive cash for, also known as “money in.” Excel is a powerful tool that helps individuals and businesses organize and analyze data to make informed decisions. With the rise of data-driven decision making, knowing how to add data analysis in Excel is becoming…

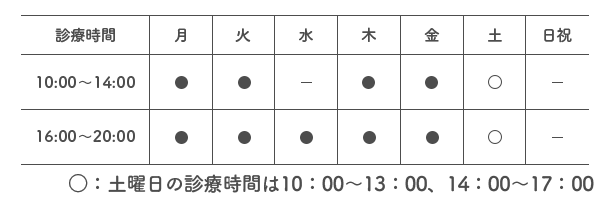

SMiLE 整骨院

| 診療時間 |  |

|---|---|

| 住所 | 〒112-0006 東京都文京区小日向4-5-10 小日向サニーハイツ201 |

| アクセス | 東京メトロ丸の内線「茗荷谷」駅 徒歩2分 |